Key Takeaways

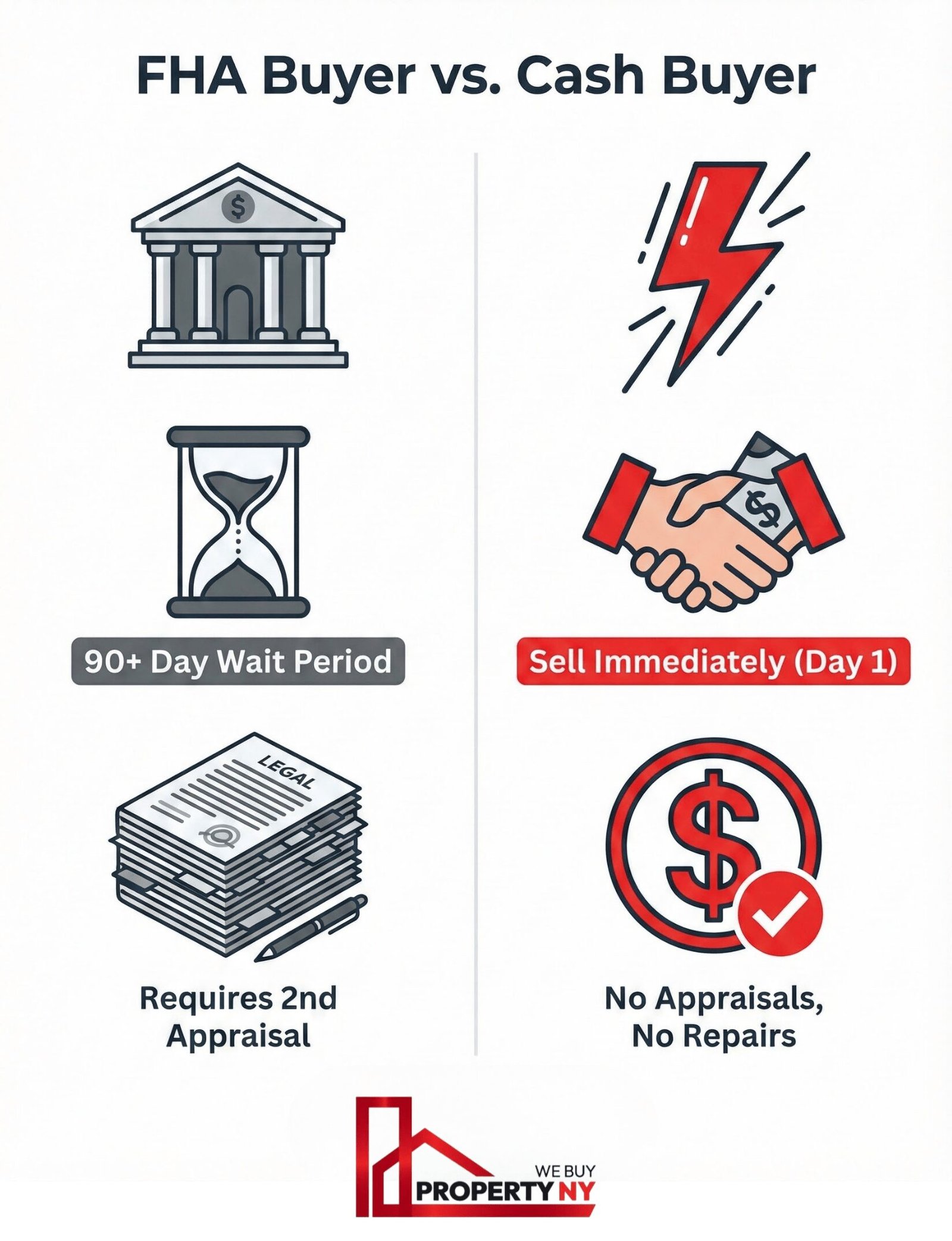

- Legal vs. Financial: You can legally sell immediately, but buyer financing (FHA/Conventional) often requires a 90-day wait.

- The Rule: FHA will not insure a mortgage if the contract is signed within 90 days of the seller’s deed recording.

- The Solution: Cash buyers avoid these “seasoning” rules entirely, offering the fastest exit for busted flips.

- Tax Bomb: Selling in under one year triggers Short-Term Capital Gains and potential NIIT taxes.

- NY Closing Cost: Sellers must budget for the NY Real Property Transfer Tax (1.4% to 2.075%).

You just closed on a property in New York, perhaps as a fix-and-flip, but the market has shifted. Maybe the rehab costs blew your budget, or interest rates spiked. Now, holding costs are eating into your profit, and you need to liquidate the asset immediately. The urgent question is: How quickly can you legally resell the property without scaring off buyers?

You just closed on a property in New York, perhaps as a fix-and-flip, but the market has shifted. Maybe the rehab costs blew your budget, or interest rates spiked. Now, holding costs are eating into your profit, and you need to liquidate the asset immediately. The urgent question is: How quickly can you legally resell the property without scaring off buyers?

While you hold the deed and can technically sell the property the next day, financing rules often block the sale. According to the HUD Handbook 4000.1 (FHA Single Family Housing Policy), a property is not eligible for an FHA-insured mortgage if it is resold within 90 days of the seller’s acquisition.

This guide explains how the “90-Day Flip Rule” impacts your exit strategy in New York, the hidden “title seasoning” restrictions used by conventional lenders, and why professional cash buyers like WeBuyPropertyNY are often the only viable solution for a rapid exit.

What is the ‘FHA 90-Day Flip Rule’?

To navigate this rule, you must understand that it restricts the buyer’s loan, not your right to sell. The Federal Housing Administration (FHA) implements this rule to prevent predatory property flipping and artificially inflated home values.

How the Clock Works (HUD Guidelines)

Precision is critical here. If you miscalculate the dates, your deal will die at the closing table.

- The Start Date (Acquisition): The clock starts on the date your deed was recorded at the county clerk’s office (this may be days after your actual closing).

- The End Date (Resale): The clock stops on the date you and the new buyer sign a valid purchase contract.

If the time between the deed recording and the new contract is 90 days or fewer, FHA financing is strictly prohibited. The lender cannot insure the loan.

The Danger Zone: Days 91–180

Even after the 90-day blackout period, you aren’t entirely in the clear. If you resell the property between 91 and 180 days for a price that is 100% or more over your purchase price, the FHA requires a second appraisal.

The Catch: The lender will use the lower of the two appraisals. You must prove the value increase is due to legitimate renovations, not just market speculation.

Why This is a Problem for You (The Seller)

Why This is a Problem for You (The Seller)

The FHA 90-day restriction isn’t merely an inconvenience; it imposes direct, measurable risks on your investment’s profitability and timeline. For an investor facing tight margins, delaying the sale by three months can be financially disastrous when you are asking, how fast can I sell my house after buying it.

Blocking the Primary Buyer Pool (Demand Collapse)

If you choose to list your property during the 90-day seasoning period, you are effectively self-selecting out of the largest segment of the retail market: first-time buyers.

- NYC Market Dependency: In high-cost metro areas like New York City and Long Island, FHA financing (with its 3.5% down payment) is often the only realistic path to homeownership for many entry-level buyers.

- 80% of Demand Lost: Nationally, FHA loans support over 80% of first-time homebuyers. By listing on Day 45, you instantly lose access to this critical mass of qualified purchasers. Your buyer pool shrinks drastically to cash investors and highly qualified conventional loan users.

Direct Financial Impact: Reduced Profitability

When demand collapses, the negative effects on your profit margin are immediate and cumulative:

- Fewer Written Offers: With limited competition, you lose the opportunity for bidding wars and best-and-final scenarios, significantly lowering the ceiling on your selling price.

- Stale Listing Stigma: Properties that sit past the typical Days on Market (DOM) period are viewed by agents and buyers as having a hidden problem. This often forces subsequent price cuts, which are always more painful than starting lower, eventually increasing your carrying costs (interest, insurance, utilities) in the process.

Ultimately, trying to sell inside the 90-day window can transform a potentially profitable flip into a liquidity crisis, precisely because you eliminate the competition needed to justify your After Repair Value (ARV).

Financial Reality Check: Capital Gains & NY Transfer Tax

For a serious investor, the financial implications of selling quickly are more impactful than the FHA rule itself.

Short-Term Capital Gains Tax: Profits from any asset held for less than one year are taxed as ordinary income, not at the lower long-term capital gains rate. For high earners, this federal rate can reach 37%, plus the 3.8% Net Investment Income Tax (NIIT), alongside New York State and City income taxes. This massive tax hit could wipe out any projected profit. Ensure your gain is calculated correctly against the Adjusted Cost Basis (purchase price plus documented rehab costs).

NY Real Property Transfer Tax (RPTT): As the seller, you are typically required to pay the New York State and City Real Property Transfer Tax. This rate is usually between 1.4% and 2.075% of the sale price depending on the value and location (NYC vs. outside NYC). This mandatory closing cost significantly reduces your net proceeds and must be accounted for before you even factor in capital gains.

The Solution: How to Sell Inside the 90-Day Window

If you cannot wait 90 days due to expensive hard money loan payments or liquidity issues, you generally have three options:

- Wait it Out (Risky if the market dips).

- Find a “Non-QM” Buyer (Rare for first-time buyers).

- Sell to a Cash Buyer (The most predictable path).

Why Cash Buyers Bypass the 90-Day Rule

The FHA 90-day rule and bank seasoning requirements apply only to mortgage lenders. They do not apply to cash transactions. See the comparison below:

| Traditional / FHA Buyer | Cash Buyer (WeBuyPropertyNY) |

|---|---|

| Appraisal Required: Must meet value & safety standards. | No Appraisal: Price is agreed upon directly. |

| Seasoning: Must wait 91+ days to sign contract. | No Seasoning: Close as soon as title clears (7-14 days). |

| Condition: Renovations usually required before loan approval. | As-Is Condition: No more renovation spending. |

WeBuyPropertyNY: The Investor’s Exit Strategy

At WeBuyPropertyNY, we specialize in working with other investors who need to exit a project efficiently. We understand the pressure of hard money loans and carrying costs.

- We Buy As-Is: Stop the bleeding on rehab costs.

- We Are Cash Buyers: We do not rely on bank financing, so the FHA 90-day clock does not apply to us.

- Fast Closing: We can coordinate a closing date that stops your interest clock immediately.

If you are asking, how fast can I sell my house after buying it because your project has hit a wall, we can provide a firm cash offer usually within 24 hours.

Conclusion

The real secret behind the FHA 90-day flip rule is that it doesn’t limit your right to sell—it limits your buyer’s ability to borrow. In the New York starter home market, relying on FHA buyers is standard, making this rule a major hurdle for short-term flips.

If you are an investor who needs to liquidate a property inside that 90-day window, you cannot rely on the retail market. The most reliable way to turn a troubled project into liquid capital is to sell directly to a professional cash buyer like WeBuyPropertyNY.

Ready to stop your holding costs? Contact WeBuyPropertyNY today for a no-obligation cash offer.

Are you ready to start?

Get a fair cash offer and skip the 90-day wait.

Why This is a Problem for You (The Seller)

Why This is a Problem for You (The Seller)